In today’s fast-paced world, mobile banking has become an integral part of our lives. With the advent of Chase Mobile, customers now have the convenience of accessing their financial information and conducting transactions on the go. In this article, we will explore the features, benefits, and drawbacks of Chase Mobile, shedding light on its use in the modern era.

Features and Functionality

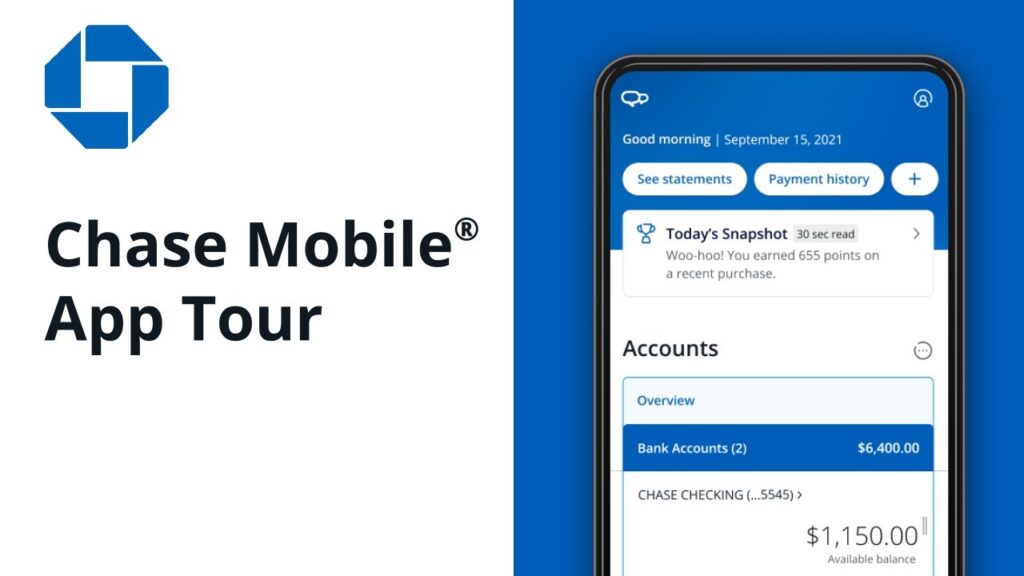

Chase Mobile offers a myriad of features designed to simplify banking for its customers. By leveraging cutting-edge technology, this mobile banking app has revolutionized the way we manage our finances. Here are some noteworthy features:

- Seamless Account Access: With ChaseMobile, users can access their accounts anytime, anywhere. Whether it’s checking your balance, reviewing recent transactions, or transferring funds between accounts, the app provides a seamless experience.

- Mobile Deposits: Gone are the days of visiting a physical branch to deposit a check. ChaseMobile allows users to capture images of their checks and deposit them directly into their accounts using the app. This feature saves time and eliminates the need for manual check handling.

- Bill Payments: Managing and paying bills becomes effortless with ChaseMobile. Users can schedule one-time or recurring payments, ensuring bills are paid on time, all from the convenience of their mobile devices.

Pros of Chase Mobile

Chase Mobile offers several advantages that make it a compelling choice for modern banking. Let’s delve into some of its key benefits:

- Convenience: The ability to access banking services from anywhere at any time provides unparalleled convenience. With ChaseMobile, users no longer have to rely on physical branches or adhere to strict banking hours.

- Time-saving: Gone are the days of standing in long queues at the bank. ChaseMobile allows users to perform a wide range of banking tasks, such as transferring funds, paying bills, and depositing checks, with just a few taps on their mobile devices. This saves valuable time and effort.

- Enhanced Security: ChaseMobile takes security seriously. The app employs robust encryption protocols and multi-factor authentication to ensure that user information and transactions are protected from unauthorized access. This emphasis on security gives users peace of mind when using the app.

Cons of Chase Mobile

While Chase Mobile offers numerous benefits, it is essential to consider the drawbacks as well. Here are some potential cons of using Chase Mobile:

- Limited Personal Interaction: One of the downsides of mobile banking is the reduced opportunity for face-to-face interaction with bank representatives. Some customers may prefer the personal touch and guidance provided by in-person banking.

- Dependence on Technology: Chase Mobile relies on technology, which means that users must have access to a compatible mobile device and a stable internet connection. In case of technical issues or outages, users may experience disruptions in their banking activities.

- Security Concerns: Although Chase Mobile incorporates robust security measures, no system is entirely foolproof. Users must remain vigilant about protecting their login credentials and regularly update their devices to mitigate potential security risks.

Conclusion

Chase Mobile has revolutionized the way we bank in the modern era. Its user-friendly interface, advanced features, and enhanced convenience make it a popular choice among customers.

However, users should also be aware of the limitations and potential risks associated with mobile banking. Overall, Chase Mobile provides a powerful tool for managing finances on the go, offering a seamless and secure banking experience.